With so much competition in the European banking market, we, the customers, are finally kings. We get to pick and choose whichever bank account suits us the most after we try them out. This is even easier knowing how easy it is to open and close these accounts.

I have used and further researched dozens of mobile digital banks in the EU, but also worldwide. With this knowledge and experience, I’ve made a list of the best digital-only banks in the EEA/EU.

I’ll start with the best bank for each separate category and finish with other notable digital banks and digital banking apps in Europe.

When you are choosing a mobile bank, always ensure to check websites such as TrustPilot to see what other past and existing users are saying and what are some of the pain points of these banking apps.

Most of the following challenger banks also have a standalone review on our website that you can check out as well.

- Best Digital Bank Overall – Revolut

- Best Free Accounts – Wise

- Best Paid Accounts – Revolut (Metal)

- Best for Savings Accounts – bunq

- Best for Travel – Revolut (Metal)

- Best for Metal Cards – N26 (Metal)

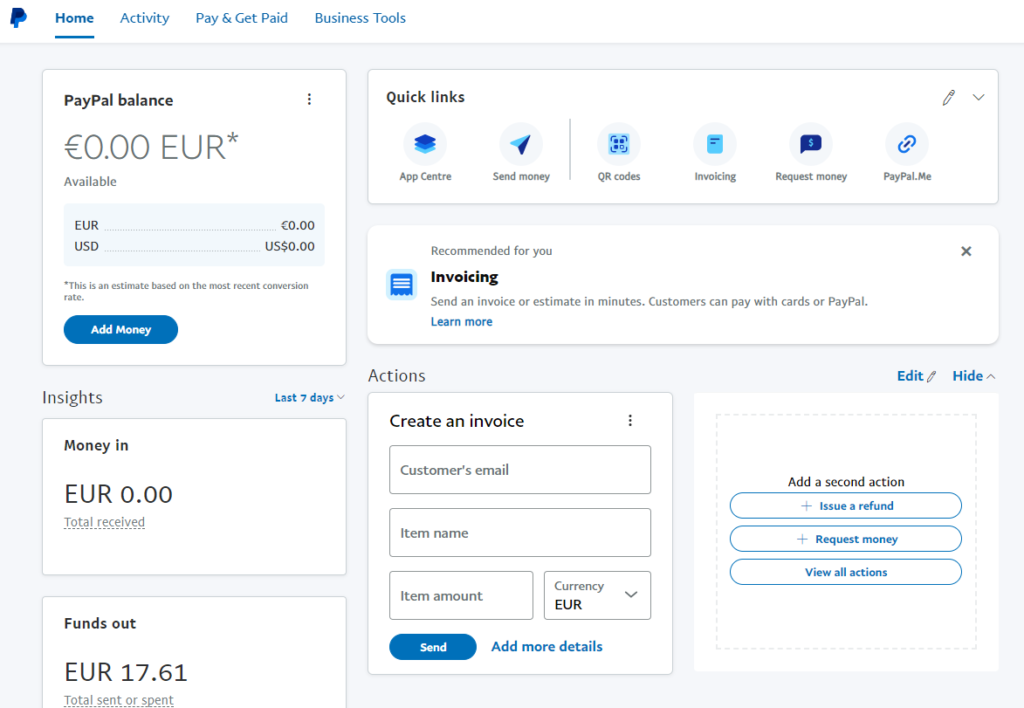

- Best for Convenience – PayPal

- Best for Businesses – Anytime

- Best for Freelancers – Holvi

- Best for E-commerce – Payoneer

- Best for Cashback – Curve

- Best for Investing – Lunar

- Best for International Money Transfers – Wise

- Best for the Environment – Tomorrow

- Best Digital Wallet – Apple Pay

- More digital banks in Europe

Best Digital Bank Overall – Revolut

| Pros | Cons |

|---|---|

| Free account available | The best features are in paid accounts |

| Multi-currency accounts | Poor customer support |

| Instant international money transfers | Some customer accounts are frozen temporarily due to security reasons |

| Connect all your bank accounts | No savings interest rates in most countries |

| Daily discounts and cashback | |

| Great for traveling and sending money abroad | |

| Stocks, crypto, and commodities trading |

Revolut is one of the biggest digital banks in the world that is present worldwide and has over 25 million clients and more than 500,000 businesses under its belt.

But just because it’s one of the largest and most popular challenger banks, does that mean it’s one of the best? To be honest, it does. I have used Revolut for many years in different European countries, and no other digital bank account in the EU comes even close.

It comes with four different plans that range from free to €13.99 per month. I obviously prefer the top account called Metal, even though it costs that much.

My traditional bank account costs almost the same, and It’s almost completely barebones, with no perks or benefits outside what you’d expect from a bank account.

With Revolut, you can open 1-5 accounts for kids, invest in stocks or crypto from €1, get many travel benefits and spend your hard-earned money abroad like a local as you’ll get the real exchange rate.

There are, in fact, so many perks that the best thing is to check out the Revolut website or our review. The only thing that is subpar is customer service. In spite of that, it still gets much, much better customer reviews than high-street banks.

Best Free Account – Wise

| Pros | Cons |

|---|---|

| No monthly fees | 1.75% + €0.5 fee for ATM withdrawals above €200 |

| Transparent money transfers | Debit card not free and not available in all countries |

| Great exchange rates | Deposits not insured |

| Easy to sign up | No cashback |

| IBAN from 10 different countries | No savings interest rate |

| Holds 50+ currencies |

Wise is simply the best value free digital bank account in Europe (not counting the UK), and one of the best in the world.

Although there is a one-time fee of €7 for a physical debit card that you basically don’t need if you connect the account to Apple or Google Pay.

It has no monthly fees and gives you not one, not two, but 10 local account numbers (IBANs) that make it easy to get paid or simply receive money as a local.

Apart from that highlight, you can use your card in more than 200 countries and withdraw money at more than 2 million ATMs, and hold 50 different currencies in your account with low fx fees for moving the money around.

And this last point is what Wise is so famous for – the fair and transparent fees for international money transfers. I have used Wise for a couple of years and PayPal before that.

And I can tell you that Wise has hands down the lowest foreign exchange fees in the industry!

Best Paid Accounts – Revolut (Metal)

We’re back to Revolut. This UK challenger bank has offered the most benefits for its paying customers since 2016.

Not only do you get a personalized metal debit card, but you also get a much higher monthly limit for fee-free ATM withdrawals, cashback on card payments, a 40% discount on international transfers, up to 5 kids accounts, and lower crypto and stock exchange fees.

But where the Metal account (€13.99/m) excels is the travel benefits such as overseas medical insurance, car hire excess, flight and baggage insurance, winter sports cover, free or discounted lounge access, and much more.

What I like the most is the bank’s Everyday Protection package that includes (even on lower plans) ticket and event coverage, refund protection, theft and accident coverage, and safer online shopping with the app’s browser extension and virtual cards.

Best for Savings Accounts – bunq

| Pros | Cons |

| Multiple European IBANs | Tree planting only on top account |

| Free trial | Only supports Euros |

| Plant trees | Inbound Swift charges from 5€ |

| 24/7 online support | Many fees |

| Savings interest rate | |

| Switch Service | |

| Sub-accounts |

bunq is a well-known digital bank from Amsterdam that was founded in 2012 and is now a so-called unicorn worth more than €1.6 billion.

When it acquired Belgian TriCount, the bank added 5.4 million new users, making it Europe’s second-largest challenger bank, only behind Revolut.

However, when it comes to digital savings accounts, I had great trouble finding any that have worthwhile interest rates. In this regard, digital banks in Europe are still well behind their counterparts in the US, where we can see savings interest rates from 3 – 5 percent.

Here, almost none offer any interest rate at all, and the ones that do, offer very meager rates. In this picture, bunq crystalized as the bank account with the highest interest rate of 1.31% (at the time of writing) across its accounts.

It also offers sub-accounts for easy budgeting and/or saving, an autosave option, and the ability to automatically invest your spare change into stocks.

Best for Travel – Revolut (Metal)

I already mentioned many of Revolut’s travel benefits and perks. In fact, this is why most customers choose the bank.

With all the perks that I already mentioned above, travelers can also avail of currency exchange without fees during the workdays, cashback on Stays booking, and free international spending.

There’s not much more to say here, as the bank offers the best benefits for travelers, especially frequent ones.

Best for Metal Cards – N26 (Metal)

| Pros | Cons |

|---|---|

| 18g metal debit card | Can only hold one currency |

| Free payments worldwide | |

| Unlimited free ATM withdrawals worldwide | |

| Up to 10 sub-accounts | |

| Medical, trip, flight, mobility, and winter sports insurance | |

| Car rental and phone insurance | |

| Premium partner offers & unique experiences |

There are many digital banks that offer metal cards now. Although it all started with Revolut, I prefer N26 for the metal card.

The N26 flagship account is available for €16.90 per month and offers LoungeKey memberships, a dedicated priority hotline, an exclusive metal card, and more.

Frequent travelers will also benefit from all kinds of insurance on the Metal plan, including medical travel insurance (up to €1M), trip insurance, pandemic travel coverage, flight insurance, luggage coverage, and more.

Travel insurance further includes trip curtailment or cancellation coverage, luggage loss up to €2,000, and luggage delay up to €500. For flights that are delayed more than four hours, you can get compensated up to €500.

Metal users can even avail of car rental insurance up to €20,000 and phone insurance for damages and theft up to €1,000 if their phone or event is eligible.

You can select the slick metal card in three colors (Charcoal Black, Slate Grey, or Quartz Rose).

Best for Convenience – PayPal

| Pros | Cons |

|---|---|

| Widely accepted | Many fees |

| Free for many domestic transactions | High international costs |

| Convenient and easy to use | Expensive foreign exchange fees |

| Multi-currency accounts available | Some transfers take time |

| Instant credit options | Scammers love it |

| Secure |

PayPal was, and still is the king of international transactions and shopping, with more than 430 million users worldwide and $340 billion in total payment volume.

Although it doesn’t have nearly as many features that it has in the US, you can still pay online and in-store and transfer money to other people inside your country and abroad.

The fact that so many people already have a PayPal account means that you can send money in a few taps on the phone or website without worrying that you or the recipient will need to open an account first. It’s just there.

Although there are undeniably better, faster, and cheaper platforms, PayPal is and will remain the most used of them all.

RELATED: Wise Vs. PayPal (Low Fees Vs. More Features)

Best for Businesses – Anytime

| Pros | Cons |

|---|---|

| Convenient application process | Many fees and charges |

| A wide range of account types | Major accounting software not supported |

| Suits different business needs | |

| Budgeting and analytics | |

| No fees on international transactions | |

| Easy for merchants to accept card payments anywhere |

Anytime is a popular French business account available throughout Europe that offers banking services to self-employed, startups, companies, and associations.

Anytime offers an all-in-one package for freelancers and small and medium businesses. You can get up and running in ten minutes but be wary of some of the fees and limits that are unfortunately abundant.

It’s backed by Orange Bank, a 100% French bank owned by the telecom operator Orange and the national bank Grouporama.

Anytime makes it easy to open a professional account online by providing some basic information, though only EU-registered organizations may apply for the account. It offers a host of account plans to suit different professional needs.

Best for Freelancers – Holvi

| Pros | Cons |

|---|---|

| Free business card | No free account |

| Easy to open account | Not available in many countries |

| Easy invoicing | No APIs |

| Straightforward bookkeeping | |

| Up to 500 free SEPA transfers per month | |

| Reporting and analytics |

Holvi is a Helsinki-based fintech company that operates in Finland, Germany, Austria, Belgium, Ireland, and the Netherlands.

It has been licensed for operations across the EU by the Financial Supervisory Authority of Finland (FIN-FSA) and SEPA to offer freelancers and small business owners digital online-only accounts.

It makes invoicing and bookkeeping tasks that can be tedious and confusing, simple and straightforward. Which means no more scrambling when the tax season arrives.

By using Holvi, you will do your accounting as you go and be ready when the time comes to submit your reports.

Holvi has two accounts that are easy to understand and offer simple fees without any hidden charges. We recommend the €15 + VAT Pro account as it provides the most bang for the buck.

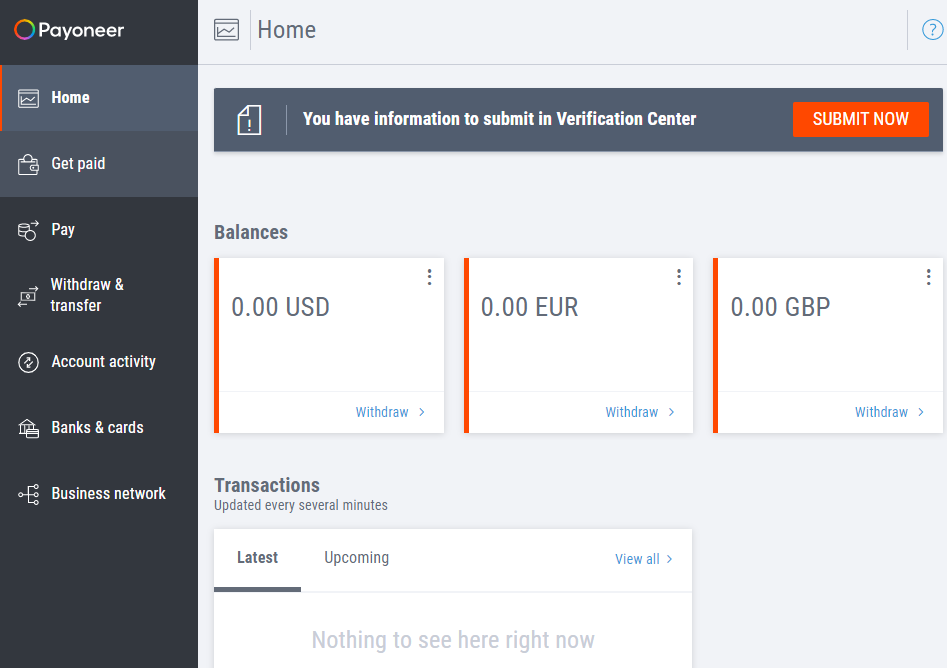

Best for E-commerce – Payoneer

| Pros | Cons |

|---|---|

| Free prepaid Mastercard | High card transaction fees |

| All the significant marketplaces supported | Strict terms and conditions |

| Make and receive payments easily | Can’t accept credit card payments |

| Currency exchange fees | Overeager fraud detecting system |

| No monthly fees |

Payoneer is a popular option for businesses and freelancers. They offer a prepaid Mastercard so you can spend your money directly from the account.

Payoneer has a wide range of payment services and solutions that make it easy to pay and get paid. Unfortunately, this comes at a cost, as some fees can quickly add up and eat a part of your profit.

They’ve partnered with so many e-commerce marketplaces that it’s easy to get paid for your services, products, or rentals, for example. Airbnb, Amazon, Booking.com, Fiver, Upwork – you name it, Payoneer has got it.

Online sellers that sell their products on Amazon, Lazada, Wish, or eBay, for example, benefit from getting paid into one account but in multiple currencies if needed.

They can easily track and manage upcoming, incoming, and outgoing payments, POS transactions, withdrawals, and fees. And with the integrated Amazon Store Manager, sellers can see the big picture by accruing all Amazon income information in one place.

Best for Cashback – Curve

| Pros | Cons |

|---|---|

| Up to 20% cashback | Free account for two cards only |

| Free account available | Amex, Maestro, and Diners not supported |

| Ability to switch transactions from one card to another | |

| Great for people with many cards | |

| Optional metal card |

Curve has been around since 2015 when Shachar Bialick, now the company’s CEO, founded the fintech in London where it’s still based.

The app first went public in Ireland and the UK in January 2018. It offers a really unique benefit to its customers, one that no other companies really offer on the market.

You can combine all your payment cards from other banks or financial institutions into one app and card. That means that you can make payments or even ATM withdrawals with just one card – the Curve card.

You can switch the bank card you paid with inside the app and even move payments from one to the other. Handy, if you’ve made a mistake.

If one of the payment cards gets declined, Curve will automatically try to use your backup card. The account is available in the EEA and the UK.

Best for Investing – Lunar

| Pros | Cons |

|---|---|

| Free account available | Doesn’t operate in Euros |

| Earn interest on your balance | Expensive overdrafts |

| Joint accounts | High exchange rates |

| Free payments and transfers | |

| Stocks, ETF, and crypto investing |

Lunar is a digital bank and investing app available in the EEA, as well as the UK. You can start investing safely in stocks, crypto, and NFTs with as little or as much money as you have available.

This Danish company offers personal and business accounts and has managed to amass more than 500,000 personal and 13,000 business users since 2015, when it was established.

It has three different accounts, of which one is free, and they all come with a free debit card, savings interest rate, exclusive discounts, and, of course, investing platform.

It only takes a couple of minutes to register for an account, and you can start investing securely, which is, of course, very important. Lunar is backed by Saxo Bank, a fully licensed and regulated Danish bank.

For beginners, it’s important that the investing platform isn’t intimidating and that it’s written in plain language that everyone can understand.

Although trades aren’t free, they have low-enough fees that it’s still worth it to invest. But because it has these fees, I wouldn’t recommend it for day trading.

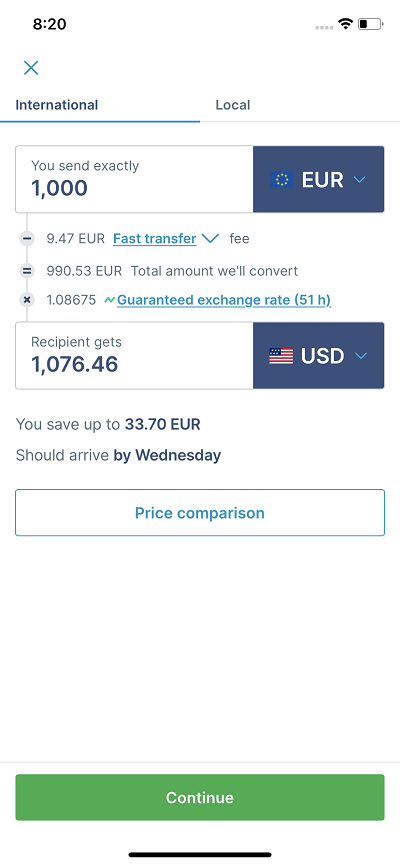

Best for International Money Transfers – Wise

We have Wise again on this list. This time it’s for the cheapest international money transfers.

The fact is that since 2011, Wise has concentrated on completing cash transfers cheaper and with more transparency.

The company almost always has the best exchange rates and adds the smallest fee on top. This is in contrast with big banks and many other money transfer services like Western Union or PayPal that add a tremendous markup to their transfers.

So, how can Wise be so much cheaper? They link their bank accounts all over the world, so you aren’t sending money directly to the recipient but to a Wise account that then transfers money in the local currency to its final destination.

You save on fees, and the recipient gets the money for free in their local currency.

Best for the Environment – Tomorrow

| Pros | Cons |

|---|---|

| Sustainable banking | No free account |

| Sustainable investing | Only German IBAN |

| Wooden card and top paid account for €15/m | No cash deposits |

| Easy to open online | |

| Available in the EEA |

Tomorrow is a highly-rated German challenger bank that is combining the comfort of mobile banking with sustainability. This so-called social business was founded in 2018 and is investing your capital in sustainable projects only.

With their bank account, you are actively protecting the environment with every purchase you make with their card. Talking about cards, you get an exclusive cherry wood card with the top account (€15/m) called Zero.

For every euro paid with your Tomorrow card, you’ll save 1 m² of rainforest from deforestation, coupled with sustainable investing and financing climate projects and businesses.

Best Digital Wallet – Apple Pay

| Pros | Cons |

|---|---|

| No monthly fees | Works only with Apple devices |

| No transaction fees | Limited features |

| No internet connection required | Instant transfer fee of 1.5% |

| Easy to use with an Apple Watch | |

| Excellent privacy |

Although iPhones aren’t as widespread in Europe as they are in the US, millions of people still have an iPhone, iPad, iMac, or iWatch. This means that Apple Pay is installed by default on these devices, too.

Worldwide, more than 500 million people use it.

For what other reasons is Apple Pay so popular? First, I don’t have to take any physical cards with me anymore or even get one from the bank. Apple’s Wallet also makes it easy to pay online as it’s available on many websites as well.

Setting it up is also quite easy if you have iOS because it’s already on your device. You just take a photo of your bank card, and you’re on your way.

Apart from bank cards, you can also add your loyalty cards, tickets of all sorts, boarding passes, driver’s licenses, IDs, digital keys, and so on.

There are other alternatives to Apple Pay. For example, you have Google Pay and Samsung Pay for your Android or Samsung devices, respectively.

Other Notable Digital Banks and Digital Banking Accounts in the EU

Bnext

- Free to open

- Available only in Spain

- Trade tens of cryptocurrencies

- More than 200k users

- Financial marketplace (mortgage, loans, insurance…)

- No hidden fees

Bnext is the largest independent digital bank in Spain with more than 200,000 customers. It comes with a free account.

But the company doesn’t offer only bank accounts. This Spanish fintech company also has a comprehensive marketplace where you can find financial services and products from partner companies that offer everything from mortgages, insurance, loans, savings and investments, and more.

Bnext also has a crypto trading platform where you can buy some of the well-known tokens such as Bitcoin, Polygon, Cardano, Ethereum, XRP, Solarium, and dozens of others.

Fidor

- Easy to open online

- Available in Germany

- Account switching service

- Loans & investing

- Crypto & Forex trading

- Overdrafts

- Business accounts and cards

Fidor is a well-known German challenger bank that was established in 2009 and is one of the pioneers. The fintech company ventured into the UK market in 2015 but unfortunately had to withdraw four years later because of Brexit.

You can choose from personal and business accounts. And if you make more than 10 transactions per month, you can earn a monthly €5 activity bonus on both accounts.

Together with bitcoin.de and Kraken, Fidor successfully created the first crypto bank. Clients could integrate crypto wallets directly into the Fidor account via an API.

Monese

- Available in the EEA

- Users do not need proof of a physical address, utility bills, or credit history to open an account

- Easy to use

- Complete electronic transactions

- Link MasterCard debit card for in-person purchases

- Multi-currency options (€ or £)

- Free cash withdrawals

Monese was one of the very first challenger banks in the UK, together with Starling Bank and Revolut. Over one million customers within the EEA (European Economic Area) and more than two million in total trust Monese for their banking needs, with over three billion transactions completed each year.

Monese is also special because it allows anyone to open an account without having to provide proof of address or submit a credit check.

Orange

- Easy to open online

- Available in France

- Personal loans

- Savings accounts

Orange Bank is a subsidiary of a French telecom company and has already gathered more than 2 million users. The firm has three personal accounts ranging from free to €12.99 per month.

Apart from personal accounts, it also offers a business account for freelancers and SMEs, as well as loans, savings, and more.

Paysend

- Over 100 countries supported

- Fixed fee

- Instant transfer processing

- Paysend Global account

- Paysend Smartcard

- Business accounts

Paysend was founded in 2017 and has quickly made a name for itself as one of the latest generations of digital banks and money transfer services on the market.

They offer a card payment service to other cards and bank accounts, a global personal and business account, and a Mastercard without transaction fees at home and abroad.

Paysend is an excellent money transfer service and digital wallet for personal and business use. With a fixed transfer fee and acceptable FX rates, Paysend is on par with other money transfer services out there.

Additionally, the company offers a very capable digital bank account or wallet in which you can hold, spend, request, and, of course, send money.

Penta

- Company account within 48 hours instead of waiting for weeks

- Online account opening with German IBAN

- VISA debit cards for all employees

- Deposit insurance of up to €100,000

- Preparatory accounting for easy expense management

- Accounts from €9/month

- No hidden fees

If you’re a freelancer or a small business owner in Germany, look no further than Penta. They offer a company incorporation service and a more than capable bank account suitable for freelancers and all sorts of companies.

With a 30-day free trial, you’re welcome to try out their service before jumping the ship.

They have a quick turnaround on sign-ups and the opportunity to fine-tune your expense management with corporate cards for your employees.

Qonto

- Accessible to companies registered in France

- A complete solution for controlling your expenses

- Automate bookkeeping

- No hidden fees,

- No transfer commissions

Qonto is a digital neobank that is 100% online-only. It launched in France in 2017. It’s one of the banks designed purely for the business market, and it has been a roaring success, growing to over 200,000 business customers since.

If you’re looking for a bank for your company to use or a freelancer looking to simplify your statements, it’s hard to go wrong with Qonto.

This record-making French bank looks set for bigger and better things every year with an ever-growing array of innovations and technologies available to its customers.

Rebellion

- Available in Spain

- Aimed at a younger crowd

- Crypto investing

- Adult and teen 14+ accounts

- Flash and bank transfers

Rebellion is only available in Spain and is targeting younger customers that belong to Generation Z and Millenials. This was the first challenger bank in Spain to obtain a banking license and offer IBANs. There are now more than 250,000 customers using the app.

This neobank is also offering a crypto wallet that is ready to trade Bitcoin, Litecoin, Ethereum, Polkadot, Dogecoin, and others. Their account is free with no monthly fees or minimum balance.

Vivid

- Available in Italy, Spain, France, or Germany.

- Free Metal card (for now)

- Futuristic digital or shiny metal card designs

- Vivid Pockets

- Budgeting and analytics

- Stocks and ETF investing without commission

- Crypto investing

- Instant money transfers and payments without fees

- Bill splitting

- 107 currencies in free separate pockets

Vivid Money is a German challenger bank that was founded only in 2019. Its headquarters are in Berlin, Germany, and the company is rapidly expanding.

For now, you can only open a Vivid free or paid account if you live in Italy, Spain, France, or Germany. Their metal card is also free for now. You get it by default when you sign up for an account, as well as three months of their premium membership for free.

If, after three months, you decide to downgrade to the free account, the metal card will still stay with you! The Prime membership is €9.90 per month.

With the Vivid Standard account, you’ll get up to €20 cashback per month, 15 free pocket accounts, 40 currencies in separate accounts, free global payments, free money transfers, free direct debits, no exchange limits, free worldwide ATM withdrawals up to €200/m, and more.

The Prime account adds even more features and has higher limits than the Standard one.

Wirex

- Open an account online in minutes

- Available in Europe and worldwide

- Instant crypto transactions

- Notifications for all incoming and outgoing transactions

- Send money to your contacts in seconds

- Free ATM withdrawals up to €400 per month

- No account maintenance fees

- Zero exchange fees

Wirex was the first in Europe to offer cryptocurrency accounts linked to free physical debit cards. They already have more than 3 and a half million users worldwide.

This comes as no surprise as it offers many benefits to, not only crypto enthusiasts but regular users that have no idea what BTC or XLM even are.

The company’s mission is to make crypto more accessible and open to everyone by giving “people the power to seamlessly use their digital and traditional currency wherever they are in the world.”

If that sounds good to you, check out what features and benefits it offers to people like you, but also what cons are hindering its success.

Wittix

- Available in EEA

- Multi-currency IBAN accounts

- Free and paid personal accounts

- 75 currencies supported

- Debit card and virtual cards

- SWIFT Payments across the globe

Although Wittix is based in Las Vegas, it’s licensed and regulated by the Central Bank of Lithuania, and so its services are available for citizens of the EEA/EU. There are three personal accounts available:

- Free for EEA citizens,

- €15/m for non-EEA citizens,

- €50/m for people from high-risk countries.

If you want a physical card, it will set you back an additional one-time fee of €9 and a monthly fee of €4.9.

Businesses will have to pay from €250 to €2,500 application fee and from €50 per month up to €250.

How to Get Started with Digital Banking

Digital-only banks are known for their easy account opening process. You can open most online accounts in 5-10 minutes with little to no documents, often only with your ID.

Simply go to your desired mobile bank’s website and click or tap “Get Started” or “Open Account.” Alternatively, download the banking app from the App Store or Google Play.

To open a digital personal banking account in the EU, you’ll have to have a passport or ID and be a resident of the country where the bank in question is offering its services. Some of these banks also don’t require you to be a resident of the country. Which is even better.