Although Europe doesn’t have as many investment apps and platforms as the US, there’s still a healthy choice of apps out there.

I’ve been using, testing, and reviewing brokers on this list for many years, and I invite you to learn from my experience of what the best investing platforms on the market are.

You’ll see a couple of names in a few instances, but that’s only because they’re head and shoulders above other platforms.

Disclaimer: All investments involve risk, including loss of capital. We do not provide any offer or solicitation to buy or sell any investment products, nor does it constitute an offer to provide investment advisory services.

The material on this website is for informational purposes only and we make no guarantees as to the accuracy or completeness of its content – it is subject to change. Please conduct your own due diligence.

- Best EU Investment Platform Overall – Interactive Brokers

- Best for Beginners – DEGIRO

- Best for Copy Trading – eToro

- Best for Social Trading – Shares

- Best for CFDs – Capital.com

- Best for ETFs – Interactive Brokers

- Best for Cryptocurrency – eToro

- Best for Day Traders – IQ Option

- Best for Futures & Options – Freedom24

- Best for Active & Advanced Traders – TradeStation

- Other Notable Investment Platforms

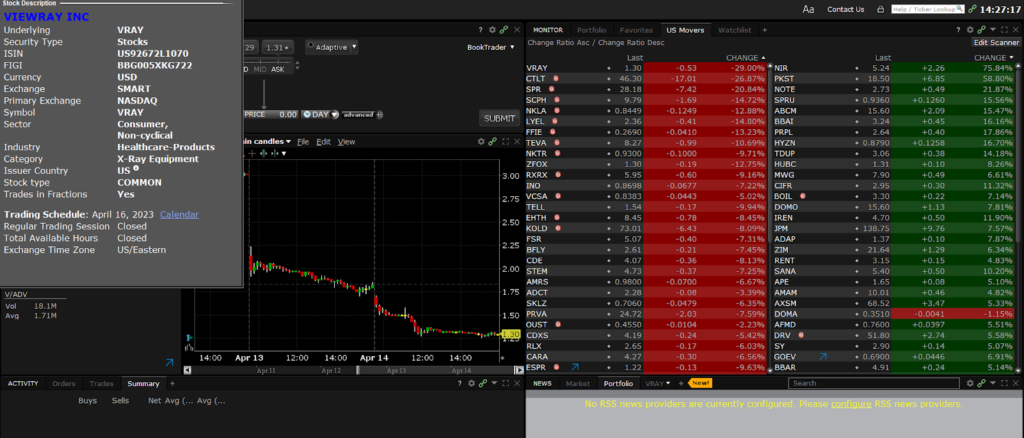

Best EU Investment Platform Overall – Interactive Brokers

| Pros | Cons |

|---|---|

| Superb GlobalTrader App for international trading | Fee-based commissions can be cumbersome |

| Fund accounts in multiple base currencies | Complex desktop trading platform |

| Wide range of products | No social trading |

| International news and research tools |

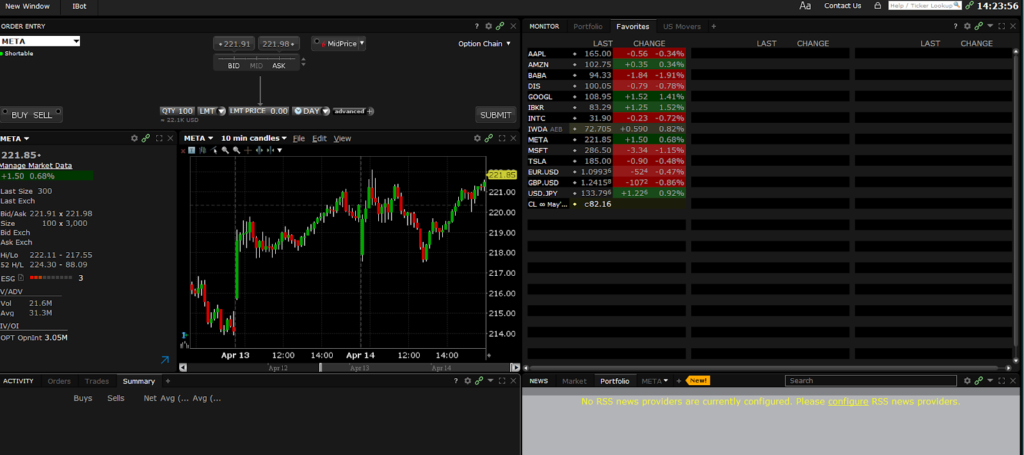

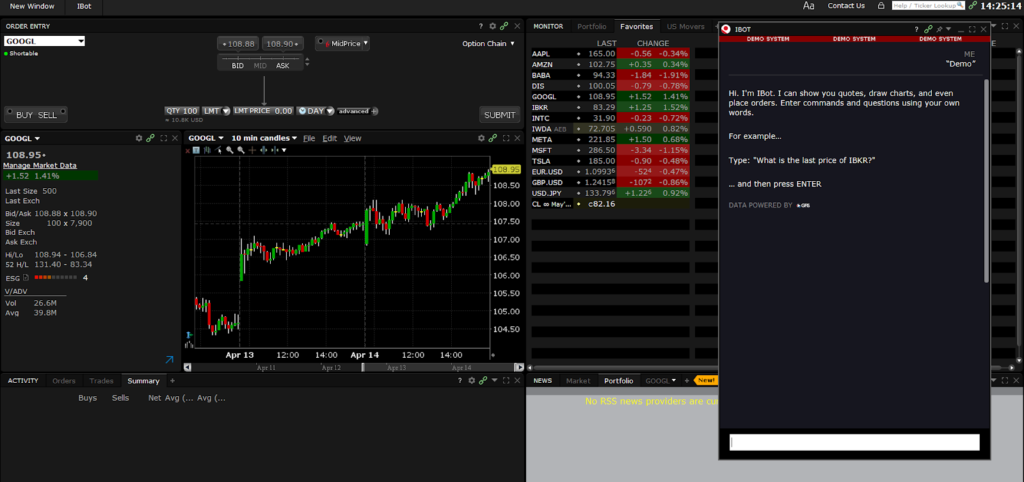

Interactive Brokers (IBKR) is one of the most complete investment and trading platforms on the market.

It was founded way back in 1978 in New York City and is often lauded as the best investing platform by reputed magazines and publications.

It’s available worldwide, including in Europe, and has desktop and mobile apps, as well as a web version.

You can use these to easily trade stocks, funds, crypto, currencies, options, futures, bonds, and more from a single unified platform on 150 global markets.

You can fund and maintain your account in any of the 20 base currencies that are supported. That way, you won’t lose any money on foreign exchange.

I love the IBKR mobile app, but I prefer to trade from the Trader Workstation (TWS), which is an advanced desktop platform.

Beginners may trade using the web version that’s also available.

In addition to those, there’s a Forex app, an app for stocks and crypto, and an app for worldwide access.

You can make a deposit without any fees, and each first withdrawal in a calendar month is free. US stocks and ETFs are commission-free for casual traders.

There are no minimum deposits, and although the whole fee structure is a bit higher than other brokers and there’s no commission-free trading, the stock loan program, FX fees, and narrower spreads make it one of the cheaper in the market.

I do miss the social trading features and copy trading, which IBKR doesn’t support.

Best for Beginners – DEGIRO

| Pros | Cons |

|---|---|

| Many financial products available | No demo account |

| App easy to use | No debit or credit card deposits |

| Some of the lowest fees on the market | Limited research functions |

| Free deposits and withdrawals | No live chat or 24/7 availability |

| Customer service in many languages | |

| Several account base currencies |

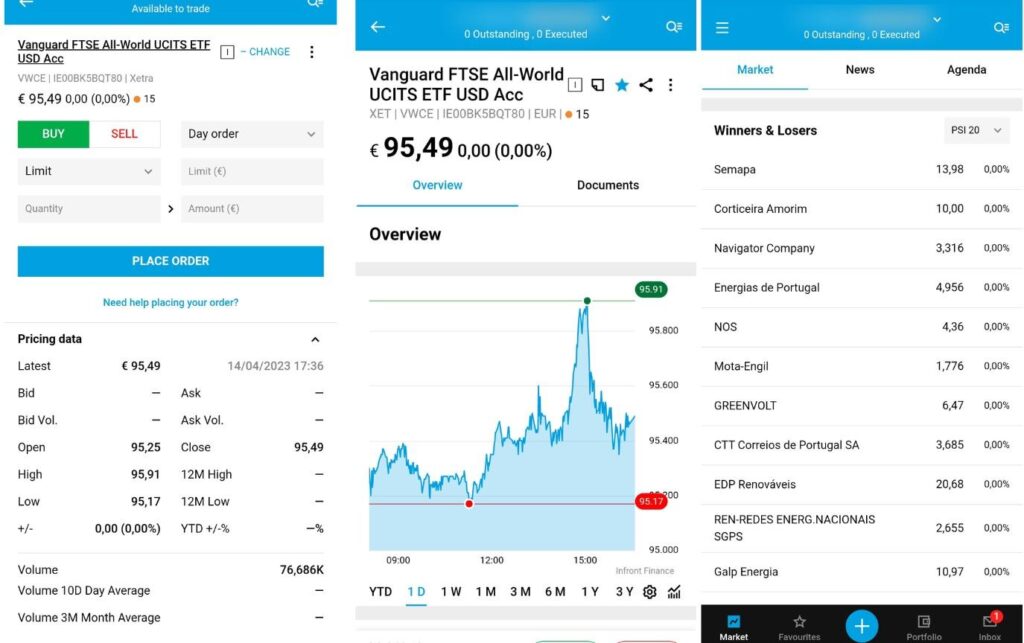

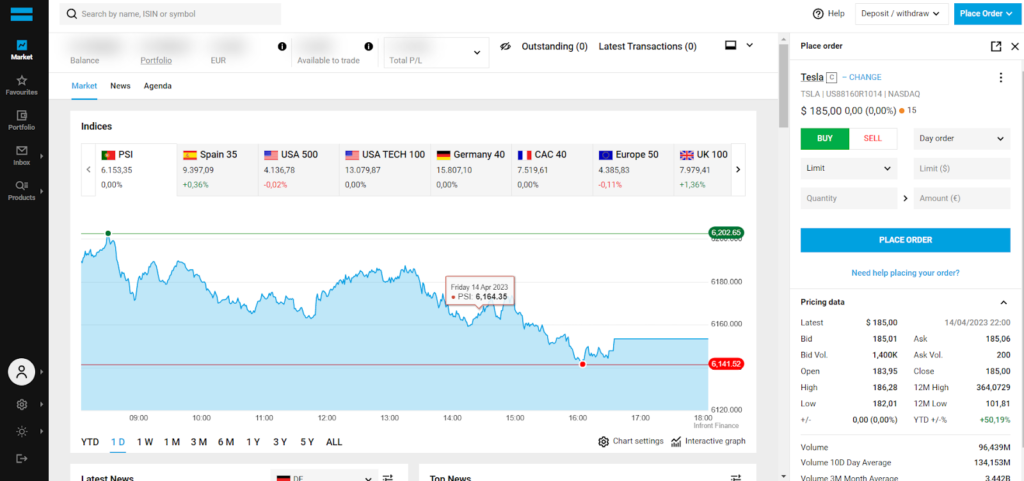

DEGIRO is an Amsterdam-based European brokerage firm that was founded in 2008. It wasn’t until 2013, the same year that Robinhood was founded, that they opened doors to retail investors like you and me.

The company was acquired by German online broker flatex AG in 2020 and the company now has more than two million customers.

DEGIRO clients profited from the acquisition by having deposit insurance of the former flatex Bank and its banking license. DEGIRO can also offer banking services now.

I’ve been using DEGIRO for the past five years. During this time period, I had no issues whatsoever, and it was the first brokerage that I ever used.

Therefore, I know how easy it is to use for beginners. It also has some of the lowest fees on the market (zero commissions on stocks and ETFs), and I benefited many times from its free deposits (they’re easy to do) and withdrawals.

Although I use only euros, you can also keep eight other currencies in your account. These are GBP, NOK, SEK, CHF, DKK, CZK, PLN, and HUF. However, if you make a deposit with a different local currency, you’ll be charged a currency conversion fee of 0.25%.

The minimum deposit is €/£1, and only deposits directly from your registered bank account via manual bank transfer are supported. No debit or credit card transfers, unfortunately.

You can invest in many different financial products, such as ETFs, stocks, bonds, warrants, futures, options, etc. However, you won’t be able to invest in Forex of CFDs.

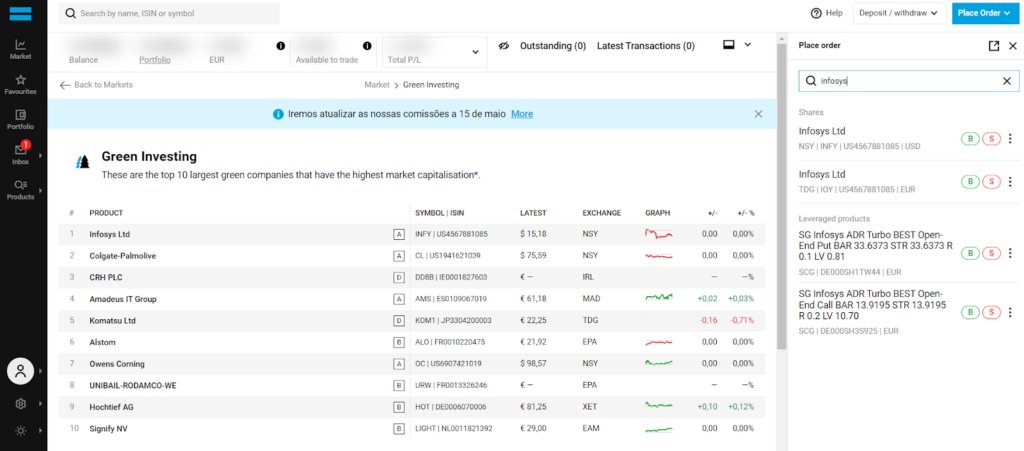

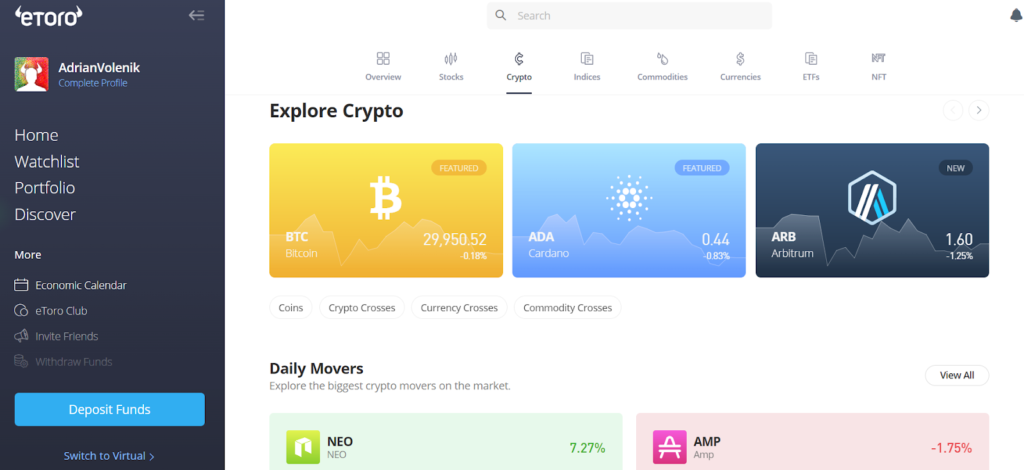

Best for Copy Trading – eToro

| Pros | Cons |

|---|---|

| Free stock and ETF trading | Limited customer service |

| Social trading | No crypto-to-crypto trading |

| Engaging community | Minimum deposit $200 |

| Educational resources |

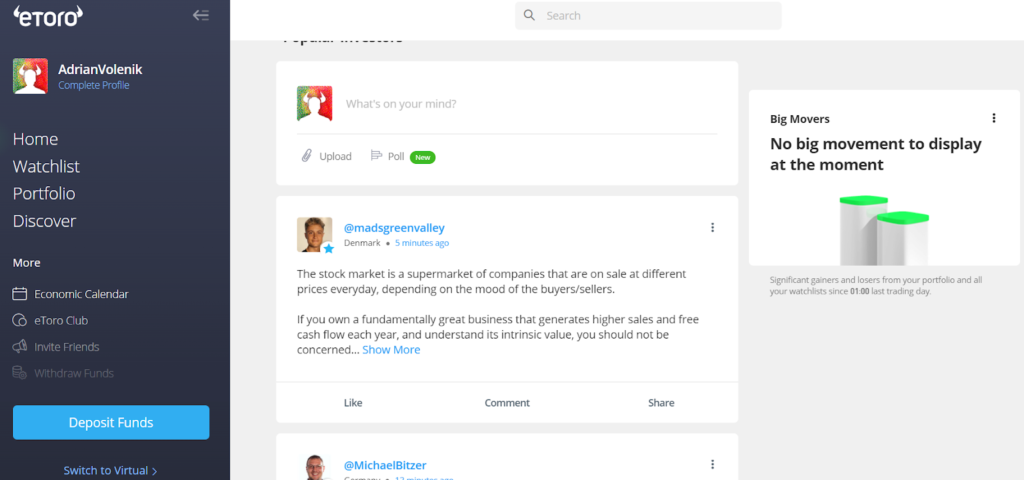

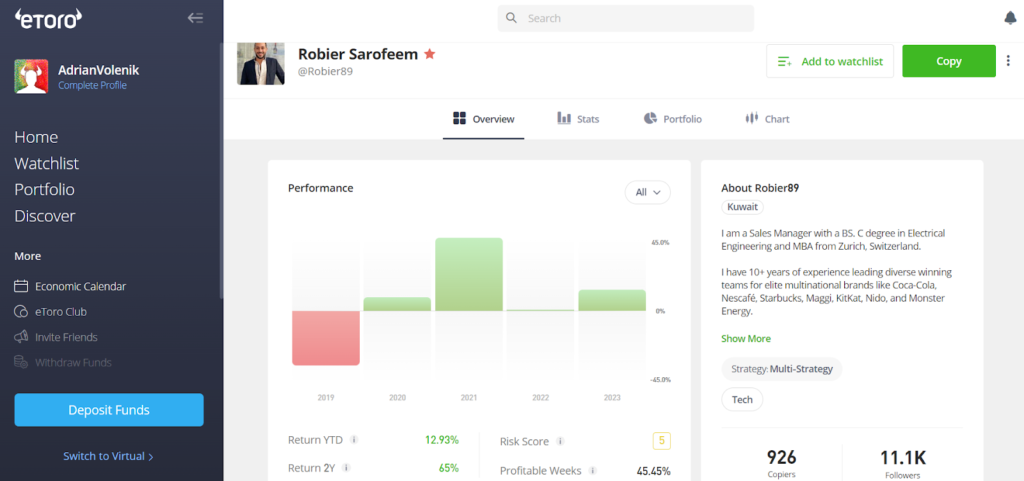

eToro was founded in 2007, and already in 2010, the company released the eToro OpenBook social investment platform. It was followed by the CopyTrader feature, which allowed beginner investors to easily copy the app’s top traders.

Although copy trading features are now everywhere, I still like eToro’s the most. It’s the sole reason why I joined it in the first place.

eToro later developed the Social newsfeed and a Popular Investor program, too. The newsfeed can also be highly addictive, just like any other social media.

You can begin investing by copying someone else’s investments by selecting an investor and hitting the “Copy“ button. It’s that easy. Of course, you can check out their stats and other information.

You can also edit your investment by adding or removing funds. This is all commission-free, and all trades you copied are replicated to your portfolio in real time.

Although copy-trading is free, the minimum amount to copy a trader is $200. That’s atypical, as most other brokers on this list don’t have almost any minimum investing requirements.

Additionally, other traders on eToro can copy you if your profile is set to public.

If they do, you’ll only earn money from this if you are participating in eToro’s Popular Investor Program.

If you’re a complete beginner or you simply want to test the features for some time before jumping in, open a demo account that comes with $100,000.

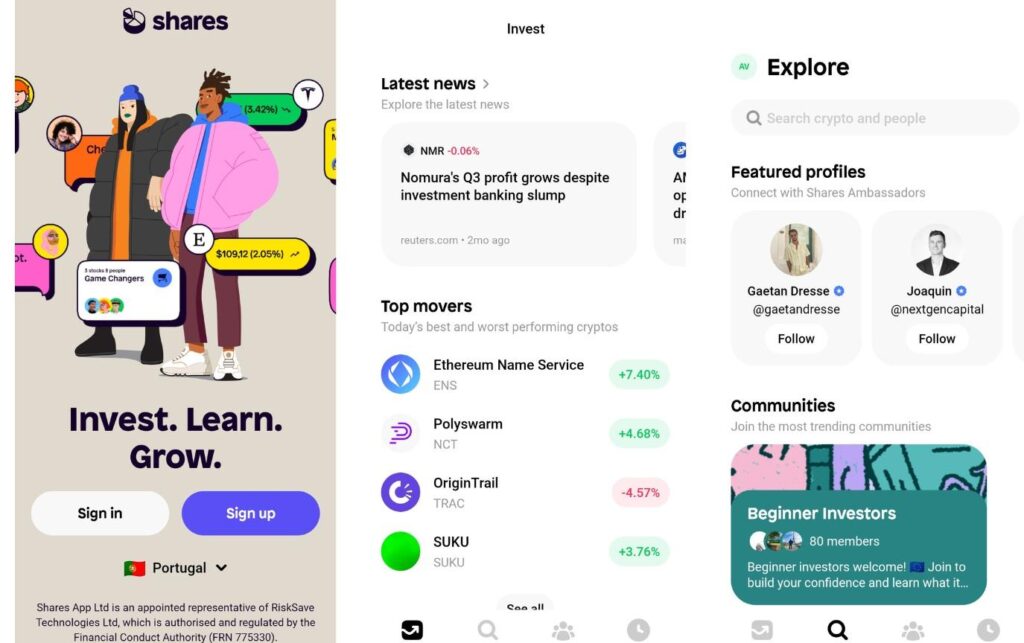

Best for Social Trading – Shares

| Pros | Cons |

|---|---|

| No commissions | Mostly crypto action on the platform |

| Easy to use | |

| Slick app | |

| Good for beginners |

Shares.io is a relatively new European startup that’s added a social twist to financial investment. Inspired by social media and eToro, you can trade over 1,000 US stocks without commission.

It was co-founded by François Ruty and Benjamin Chemla, who co-founded Stuart, a last-mile logistics company that was acquired by La Poste in 2017.

The best thing is that you can start conversations with friends, learn from others, and access market intelligence data.

You may have noticed how investment apps can look intimidating to newbies, but this app is great for beginners.

It’s slick, fast, and stripped down, but you can still access news, see the top movers, and what the most traded shares in the last period were, join communities, and write your own Twitter-like posts.

All in all, it can be quite satisfying if you’re sick of Twitter and are looking for a replacement.

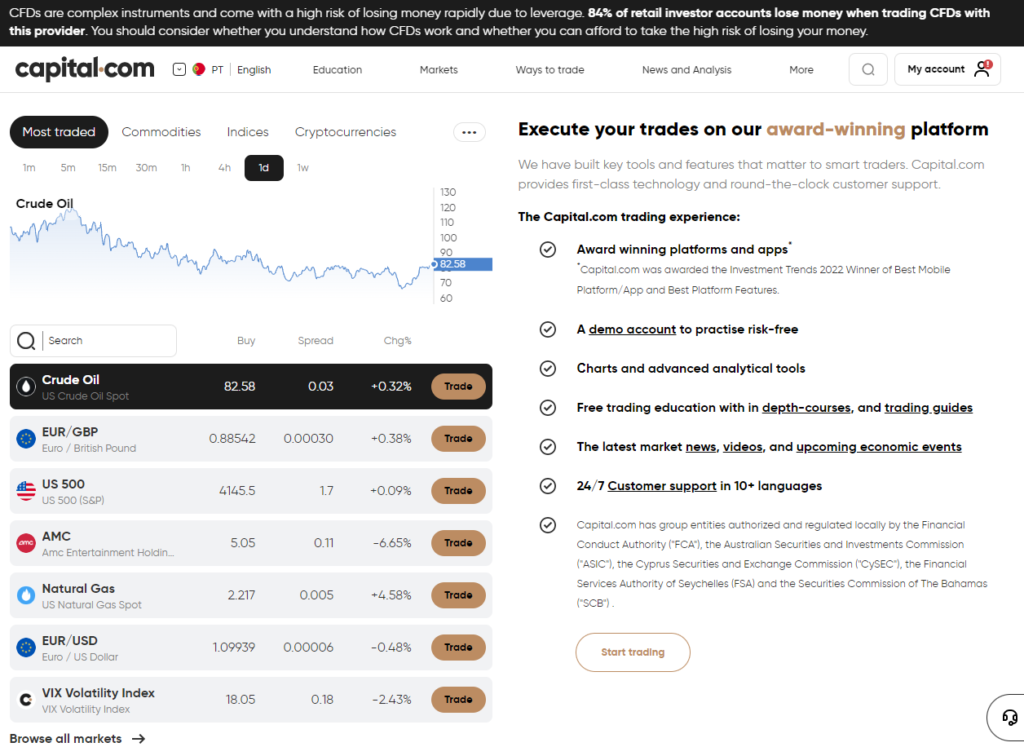

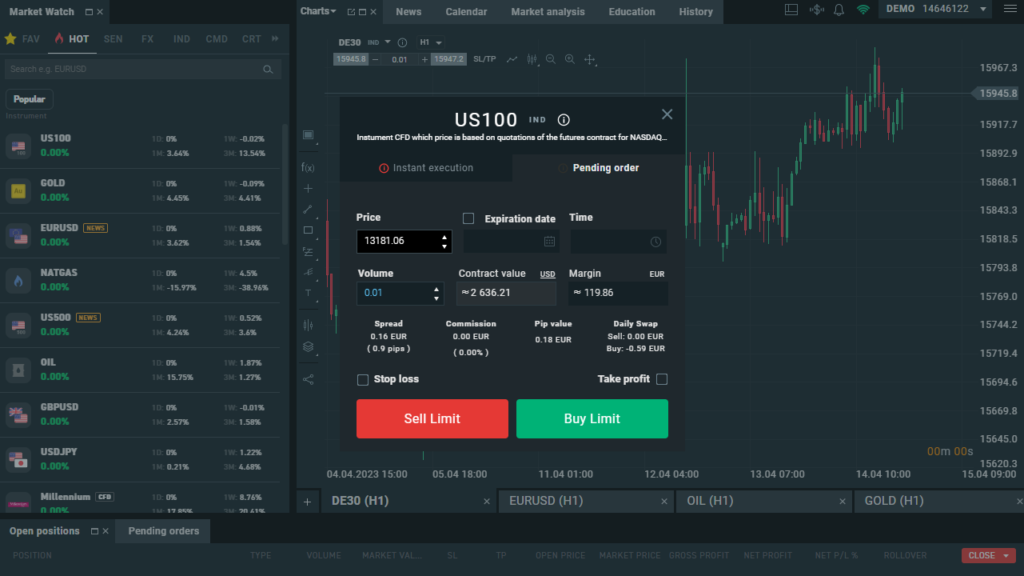

Best for CFDs – Capital.com

| Pros | Cons |

|---|---|

| No commission | Overnight fees |

| No hidden fees | |

| Fast order execution | |

| AI technology-driven platform | |

| Customer support in 24 languages 24/7 |

Capital.com is a well-known broker that was launched in 2016 and has taken the world by storm. The platform has over 7 million users, with the total trading volume crossing $1 trillion.

It’s very easy to open an account, and once you do, you have access to over 3,700 markets. However, you can only trade CFDs and not much else. Options, futures, mutual funds, bonds, and real stocks aren’t supported.

This broker’s CFD fees are some of the lowest in the industry and are built into the spread. Nevertheless, there’s an overnight fee, too.

You should know that CFDs are complex instruments and that 84% of retail investors lose money when trading CFDs with Capital.com.

Best for ETFs – Interactive Brokers

And we’re back to Interactive Brokers again. Apart from being the best in general, I also find that they’re the best for ETF investors and people researching ETFs.

Yes, anyone can use their extensive tools and platforms for global market research purposes.

Also, for all average or casual traders that are using the IBKR Lite platform, there are no commissions or fees on US-listed ETFs and stocks. And that’s where all the action is at, anyway.

For IBKR Pro users, commissions are from $0.0005 to $0.0035 per share, but they get 150+ no transaction fee ETFs as well.

Apart from US-based ETFs, European stocks and ETFs are also available, as well as ETFs in options trading and short selling.

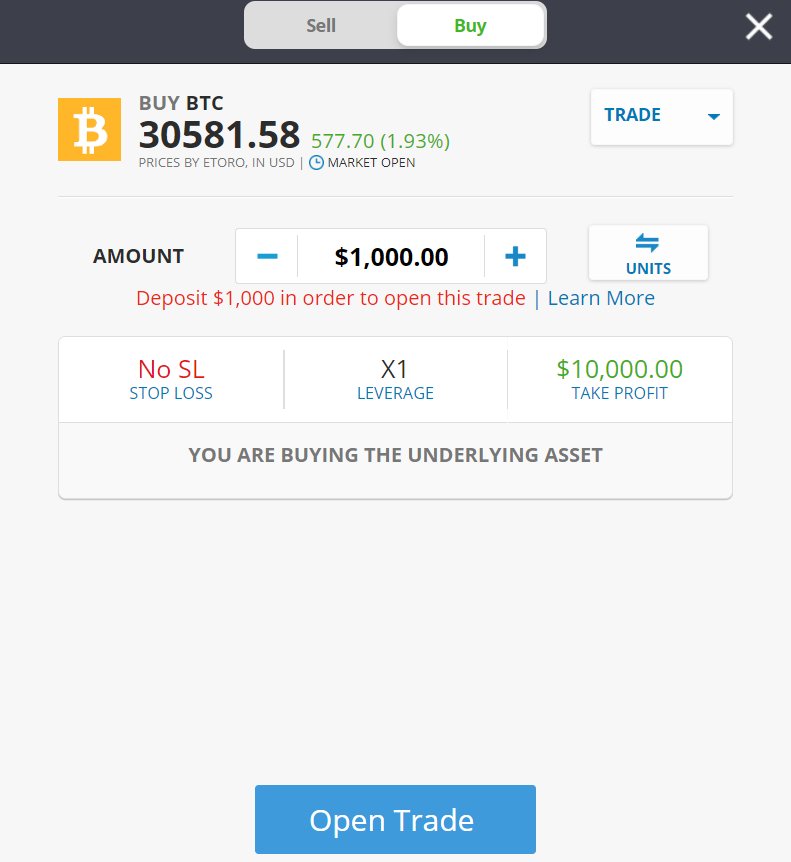

Best for Cryptocurrency – eToro

Besides copy trading, I use eToro to buy and sell crypto, and I prefer it to specialized crypto exchanges like Binance, Coinbase, and OKX.

The thing is, although I used these exchanges for many years, they can’t be trusted anymore.

They are caught up in so many grave allegations and controversies that I just can’t justify using them or even recommending them to others.

As I use it for other investments already, I took all funds from crypto exchanges and transferred them to eToro.

I also never keep my money in a crypto exchange anymore, and luckily, eToro has an easy-to-use, multi-crypto, secure digital crypto wallet. They call it eToro Money.

If you wondered, yes, there’s copy trading available for crypto, too, as well as staking.

In conclusion, yes, eToro doesn’t have all the cryptocurrencies specialized exchanges offer (it has 93), however, its fees are only 1%, and the company has a much better reputation than all the crypto exchanges combined.

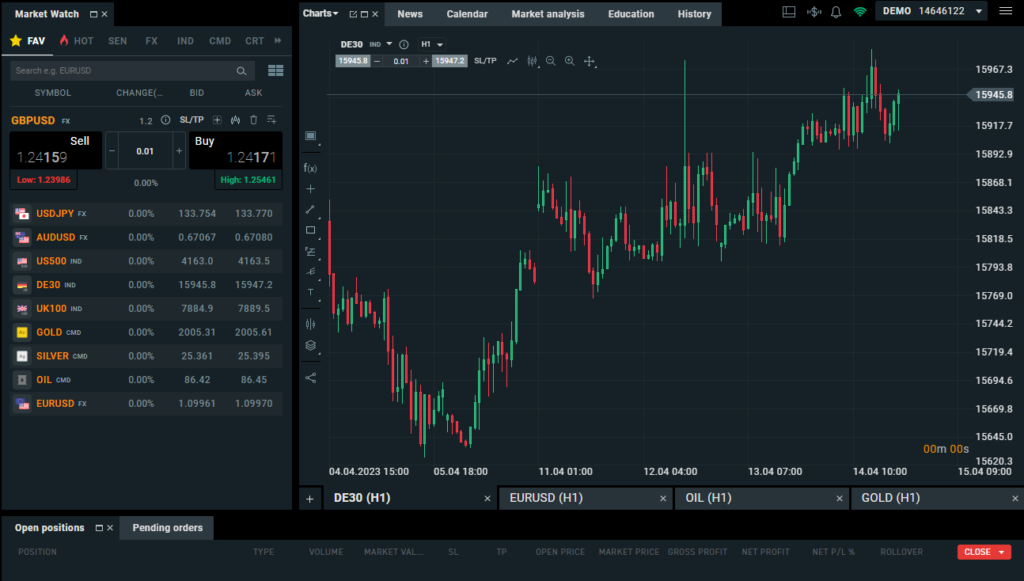

Best for Day Traders – IQ Option

| Pros | Cons |

|---|---|

| One of the most advanced platforms | Doesn’t have the widest asset variety |

| Good customer support | Only operates with derivatives |

| Very fast withdrawals | |

| Minimum deposit of just 10$ | |

| Demo account |

IQ Option is a well-known and one of the highest-rated investment platforms and has competitive fees and spreads. The minimum opening deposit is $10, but that’s no issue for day traders who will find this platform one of the best in the game.

As it’s one of the largest stocks, ETF CFD, forex, crypto, commodities, and options trading platforms in the world, and boasts advanced charts and analysis tools that will appeal to all day traders.

It comes in all forms – iOS and Android, PC and Mac, as well as a PWA platform. IQ Option has four kinds of charts – Bars, Heikin-Ashi, Line Charts, and Candles.

Graphical tools include Lines, Horizontal lines, Vertical Lines, Trend Lines, and Fibonacci Lines.

Volatility Indicators, Trend Indicators, Moving Averages, Momentum Indicators, and Volume indicators are also included.

One aspect where IQ Option doesn’t shine is the range of assets you can invest in. Make sure to check those out before you commit.

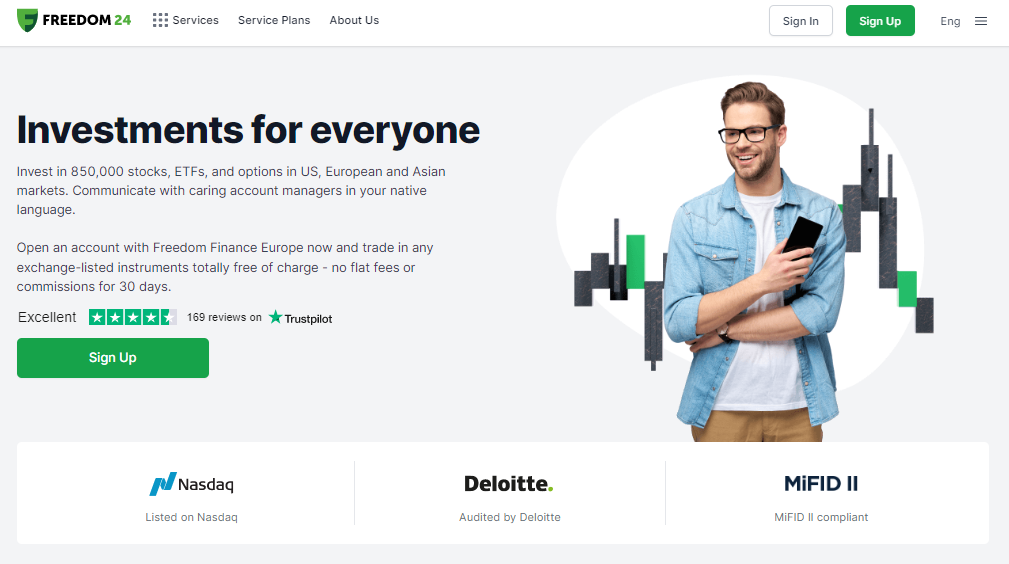

Best for Futures & Options – Freedom24

| Pros | Cons |

|---|---|

| No minimum deposit for general trading | €7 per withdrawal |

| No fees for the first 30 days | High currency conversion fee |

| Low commissions on stock and ETF trading | |

| No custody fee | |

| USD saving accounts |

Freedom24 brand is the face of international online broker Freedom Finance Europe Ltd. It was founded in 2008, and its headquarters are in Almaty, Kazakhstan. However, its main area of focus is the US stock market.

The company has been listed on the New York stock exchange (NYSE) since 2017 under the ticker FRHC. It’s still the only EU-based stockbroker to be listed on the Nasdaq.

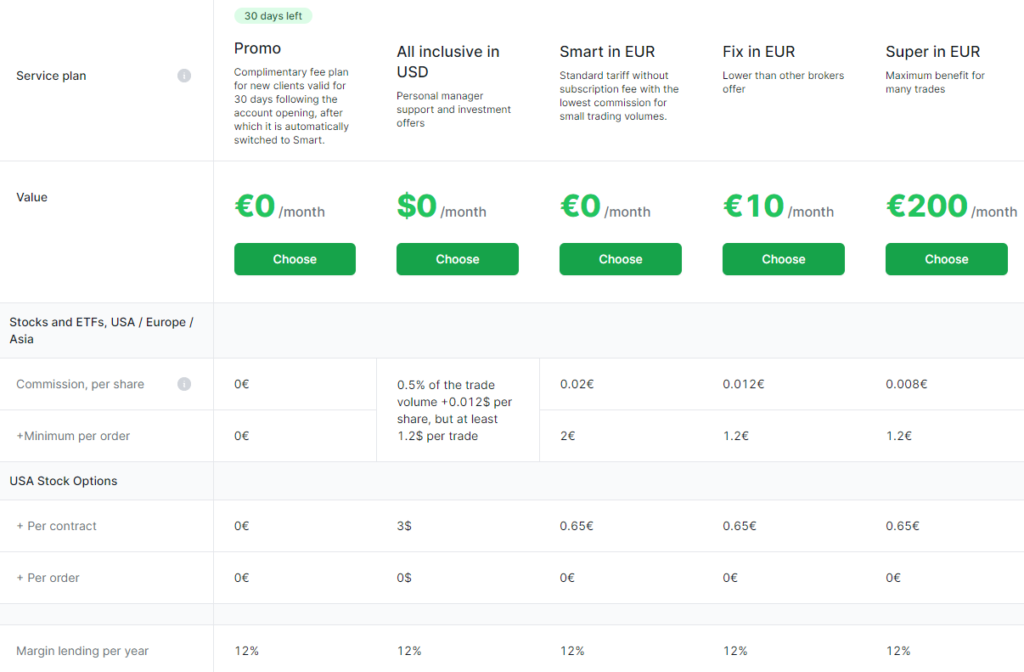

As you can see above, Freedom24 offers different plans that range from free to €200 per month. There are over a million stocks, ETFs, options, futures, and other exchange-traded instruments you can choose from.

When you open a brokerage account with Freedom24, you automatically get a D-account. If you don’t know what that is, it’s a USD savings account that pays you 3% per annum daily interest.

As it stands, this is a much better rate than what you can get in the UK and Europe with other savings accounts, and you can conveniently top-up your account quickly and easily by card or bank transfer.

You can give the Freedom24 platform a try with the Promo plan, which gives you a 30-day period without any fees.

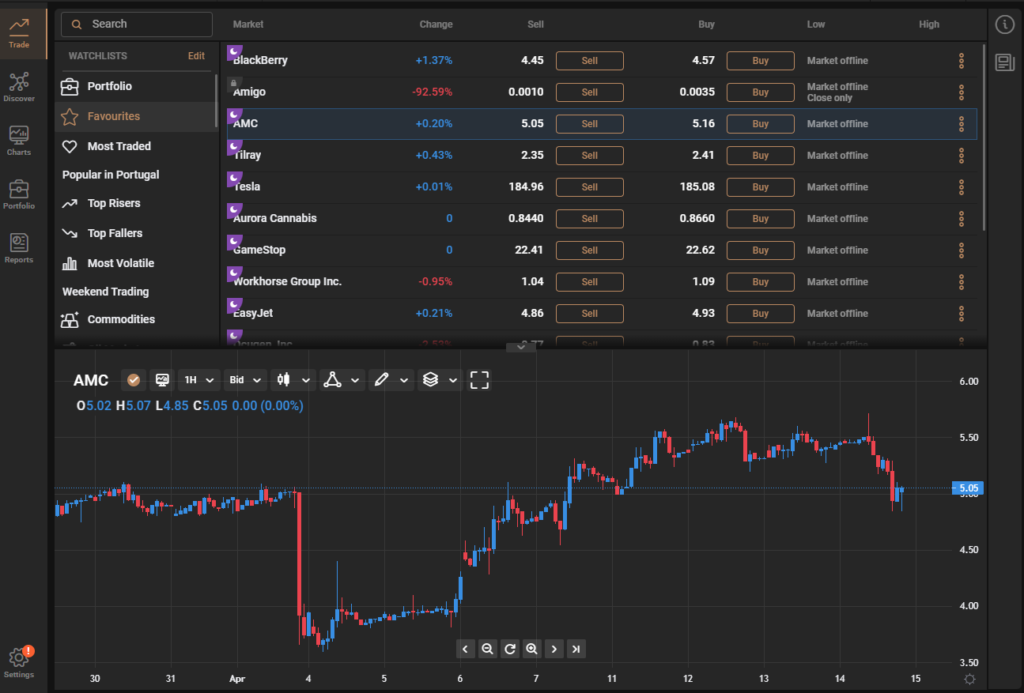

Best for Active & Advanced Traders – TradeStation

| Pros | Cons |

|---|---|

| Commission-free stock, ETF and options | Plans and pricing somewhat confusing |

| Assortment of advanced tools | Annual inactivity fee of $50 |

| Active trader community | |

| Variety of investment selections |

TradeStation is an online securities brokerage since 2001. Today it’s a self-clearing broker for equities, options, and futures, as well as for cryptocurrencies. The one thing it lacks is no-transaction-fee funds.

What I like most about it is the impressive desktop platform and app that has direct-market access, and lets you set up, try, monitor, and automate custom trading techniques for stocks, options, and futures.

With the TradeStation Simulator, you can try out new strategies in real time before committing real money.

Traders can customize the TradeStation 10 platform with hundreds of indicators or download and even code new ones.

You also have more than 90 years of daily data and decades of intraday data at your disposal and the same trading firepower as the pros.

Other Notable Investment Platforms

Alpaca Trading

- API for stock and crypto trading

- For investing, brokerage, custody, and post-trade processing

- Free stock & ETF trading

- US stocks and ETFs available

Alpaca is a startup that was founded in 2015 and has launched its trading platform in 2018 after successfully raising venture capital. It offers easy-to-use APIs that let you trade with algorithms, connect with applications, and build services.

Alpaca is almost unique and is good for beginners. However, just like DEGIRO, you can only deposit and withdraw funds via bank transfer. So, if you’re interested in buying US stocks and ETFs, Alpaca could be an excellent choice for you.

Bitpanda

- Founded in 2014 in Vienna

- Over 4 million users and 700 employees

- 2000+ digital assets

- Invest in any asset on Bitpanda from €1

- Deposit or withdraw in EUR, CHF, GBP, USD, PLN, DKK, SEK, HUF, CZK or TRY

Bitpanda is one of the biggest brokers in Europe with more than 4 million customers. And for a good reason. They offer stocks, crypto and crypto index funds, ETFs, commodities, and more.

With its intuitive interface across platforms and transparent fee information, its no wonder people are flocking in droves to the app.

Those that live in countries with euros, can apply for a Visa card that lets them spend stocks, crypto, and even metals online and in-store. There are no monthly fees and you even get 0.5% to 2% cashback per transaction.

FreeTrade

- Launched in 2018 as an independent, privately-owned startup

- More than 1 million users

- Transparent freemium pricing model

- Raised a $69m Series B investment in 2021

Freetrade is a relatively new startup that has had much success in acquiring money not only from VC but also by crowdfunding (£10 million).

You can start building your portfolio of stocks, shares, ISAs, SPACs, REITs, and ETFs from as little as £2 and commission free. Choose from three plans:

- Basic (free)

- Standard (£4.99/m)

- Plus (£9.99/m)

Each of the plans adds more value to the plate. For instance, with the Basic account, you only get the General investment account (GIA), with Standard, GIA, Stocks, and shares ISA, and with Premium, you also get a Self-invested personal pension (SIPP).

The free account also has the worst investment range of only 1,500 stocks and ETFs, compared to 6,000+ for paid plans.

For now, the app is only available in the UK, but you can join the waitlist if you live in another European country.

Trading 212

- Founded in Bulgaria in 2004

- More than 2 million funded accounts and €3.5 billion AUM

- Invest as little as €1 with Fractional shares

- Over 7,000 global Stocks & ETFs without commission

- Funds protected by the ICF up to €20,000 and additionally insured up to €1M by Lloyd’s of London

Trading 212 was founded almost 20 years ago in Bulgaria by Ivan Ashminov and Borislav Nedialkov. Since then, the brokerage has become extremely popular in Europe, with over 2 million accounts.

Trading 212 is both a CFD and a stock trading platform with zero commissions. Apart from CFDs (Commodity CFDs, Stock Index CFDs, ETF CFDs), and stocks, there are forex, and ETFs available.

You’ll be happy to know that your assets are insured up to €1 million per account.

Trade Republic

- Founded in 2015 in Berlin

- Mobile-only and commission-free broker

- More than 1 million customers and €6+ billion AUM

- 10,400 stocks and ETFs, 4,900 stock and ETF savings plans

Trade Republic is a well-known broker and securities trading bank that’s regulated by the Federal Bank of Germany and the Federal Financial Supervisory Authority (BaFin).

The platform offers commission-free trading (with a €1 per order external fee). You can invest in stocks, ETFs, crypto, and derivatives.

It’s also notable for offering a 2% p.a. Interest rate on your uninvested cash, so you can earn money even between investments.

The app has mixed reviews, and many people have highlighted the poor customer service you get from the company (email only).

XTB

- Founded in 2002 in Poland

- One of the largest stock exchange-listed FX & CFD brokers in the world

- Offices in 13+ countries, including UK, Poland, Germany, and France

- More than 650,000 customers

XTB was founded more than 20 years ago in Poland and has acquired almost three-quarters of a million clients. The company is regulated in the UK and registered with the Financial Conduct Authority, and the Polish Financial Supervision Authority.

I love XTB for its low FX spreads and emphasis on customer service. However, it doesn’t offer guaranteed stop losses (GSLO) and is one of the few prominent forex brokers that haven’t implemented this yet.

If you found this article useful, check more written by our team: