Monese is a good digital bank, however, there are some that are even better.

I’ll show you five mobile banks in the EU and the UK that I’ve personally used for years that are equally or even more capable than Monese.

The Best Monese Alternatives in the EU and the UK

If you dislike Monese or were disappointed by the app or the company for some reason, the digital banks that I’ve listed below are an excellent choice.

They offer both personal and business accounts that are free or have very few fees and charges, are widely available throughout Europe, and are fan favourites.

But they also offer cheap money transfers across the world, and, in the case of Monzo, Revolut, and N26, very fancy and distinct metal cards that come with even more perks.

These include fee-free worldwide ATM withdrawals and payments, up to 5 junior accounts, high-interest rates, phone and shopping insurance, as well as travel and medical insurance, depending on the bank.

Wise (EU & UK)

| Wise Pros | Wise Cons |

|---|---|

| No monthly fees | 1.75% + €/£0.5 fee for ATM withdrawals above €/£200 |

| Transparent money transfers | Debit card one-time fee €/£7 |

| Great exchange rates | Deposits not insured |

| Easy to sign up | No cashback |

| IBAN from 10 different countries | No savings interest rate |

| Holds 50+ currencies |

Wise is a well-known digital bank and money transfer service. You might know it by the name Transferwise as it used to be called.

It’s a London-based fintech that offers services across the world. Naturally, most features are in the UK, but EU citizens won’t lack much either.

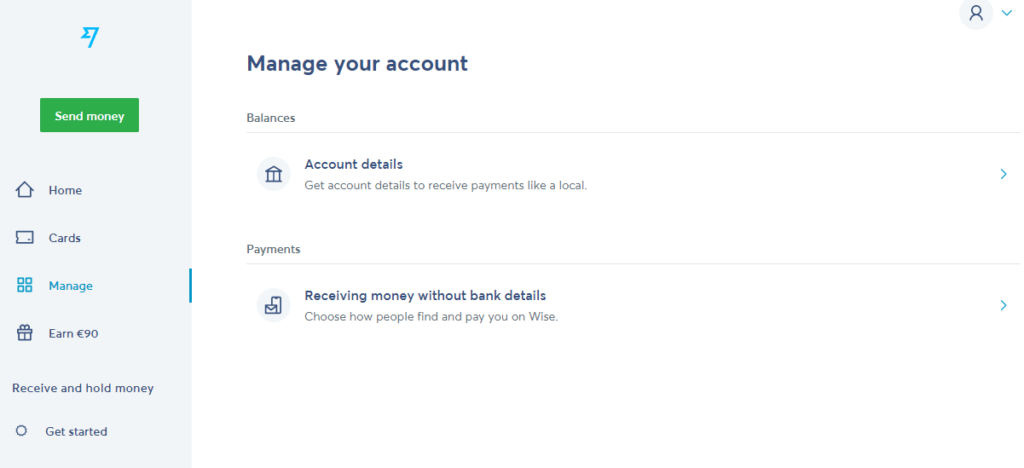

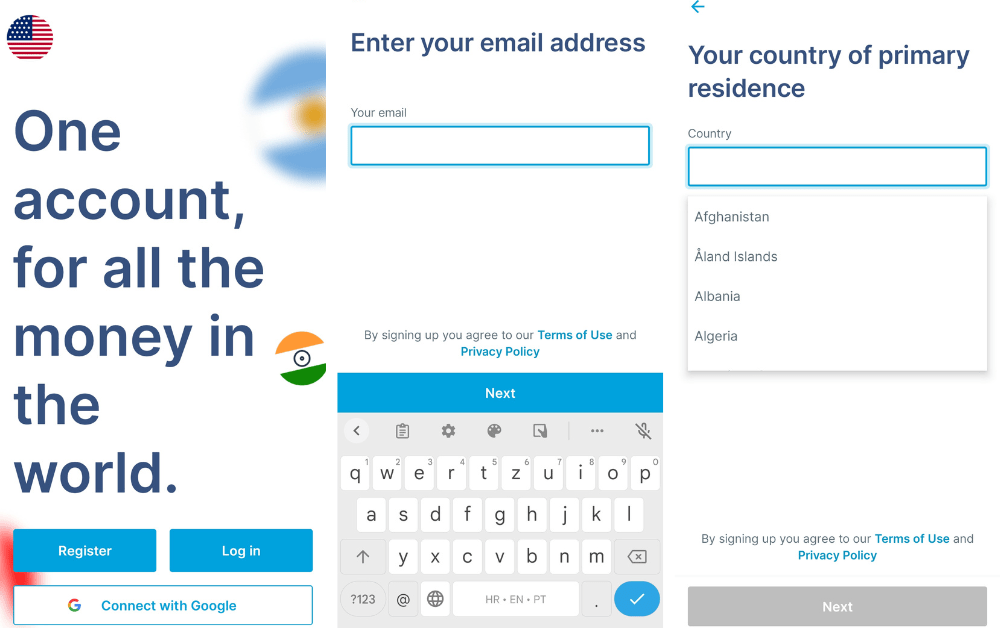

Opening an account is extremely easy. I did it in a couple of minutes using my Google account. However, you can register by using an email too.

You can open a personal or a business account and have 10 local accounts with IBAN and everything.

Although you can use the virtual card you get by default with Google, Apple, and Samsung Pay wallets to pay for things, you can also order an international Visa debit card for a one-time fee of €/£7.

Wise lets you use your card anywhere in the world and helps you withdraw money at 2+ million ATMs.

It also lets you hold around 50 currencies in your account with low foreign exchange fees to move your money between accounts.

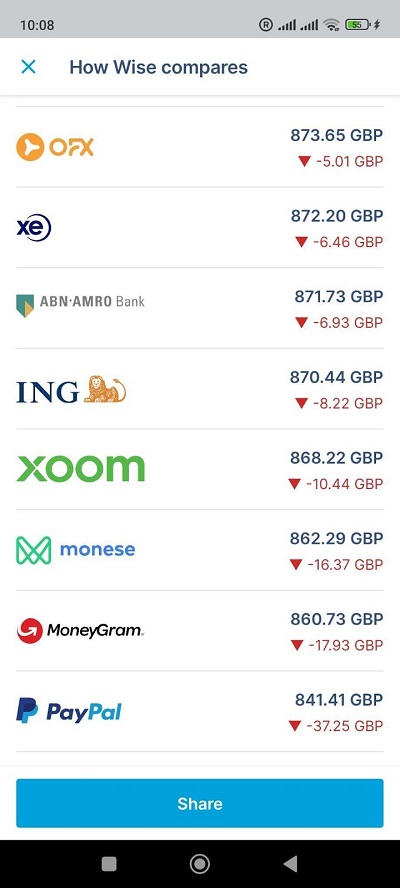

However, what I like about Wise the most, are the cheap international transfers that cost much less than banks and similar apps and services.

I mean, just look at the screenshot below.

There’s no point in giving extra money to these comparable services for basically nothing.

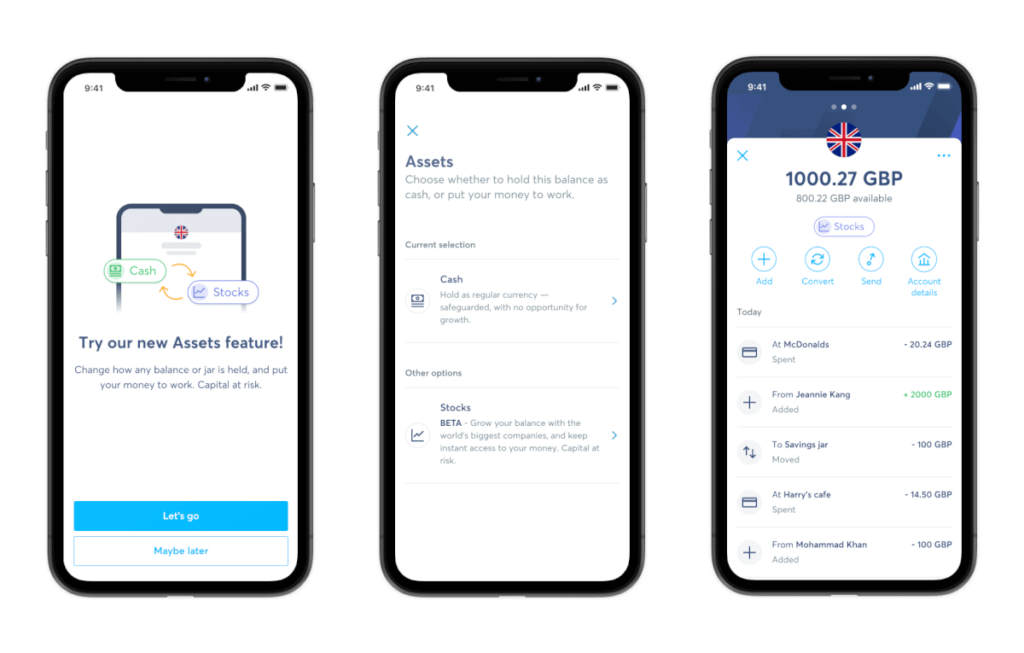

Wise users in the UK can also invest their money in stocks. There’s still a limited amount of index-tracking funds that you can invest in, but it’s a start.

Wise is also an excellent alternative to PayPal and traditional bank accounts, as you can receive payments from marketplaces like Amazon, Shopify, or Etsy without any additional fees.

With support for Stripe and easy integration, there are no valid reasons why you’d pay huge fees to banks for your hard-earned money.

Revolut (EU & UK)

| Revolut Pros | Revolut Cons |

|---|---|

| Free account available | The best features are in paid accounts |

| Multi-currency accounts | Poor customer support |

| Instant international money transfers | Some customer accounts are frozen temporarily due to security reasons |

| Connect all your bank accounts | No savings interest rates in most countries |

| Daily discounts and cashback | |

| Great for travelling and sending money abroad | |

| Stocks, crypto, and commodities trading |

Revolut is another fintech company based in London that has set their eyes on world domination. I mean, who hasn’t heard of them?

The company is now present in more than 200 countries or regions, and with 25+ million personal and more than 500,000 business users, it is one of the largest fintech companies and digital banks in the world.

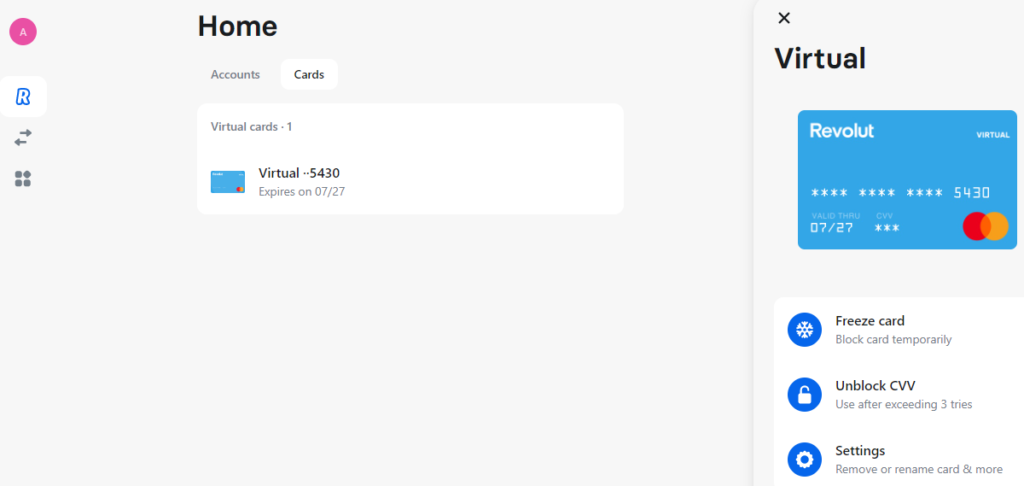

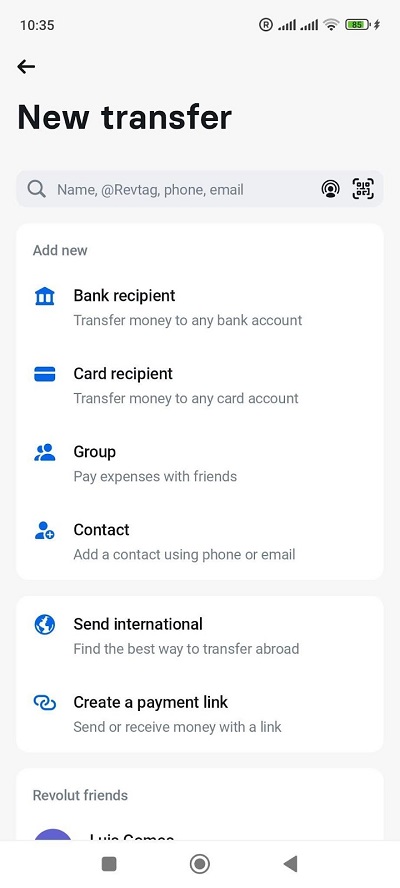

I’ve used Revolut for many years and can tell you that it’s incredibly easy to open an account. Simply download the app, enter your email and phone number, and you’re all set.

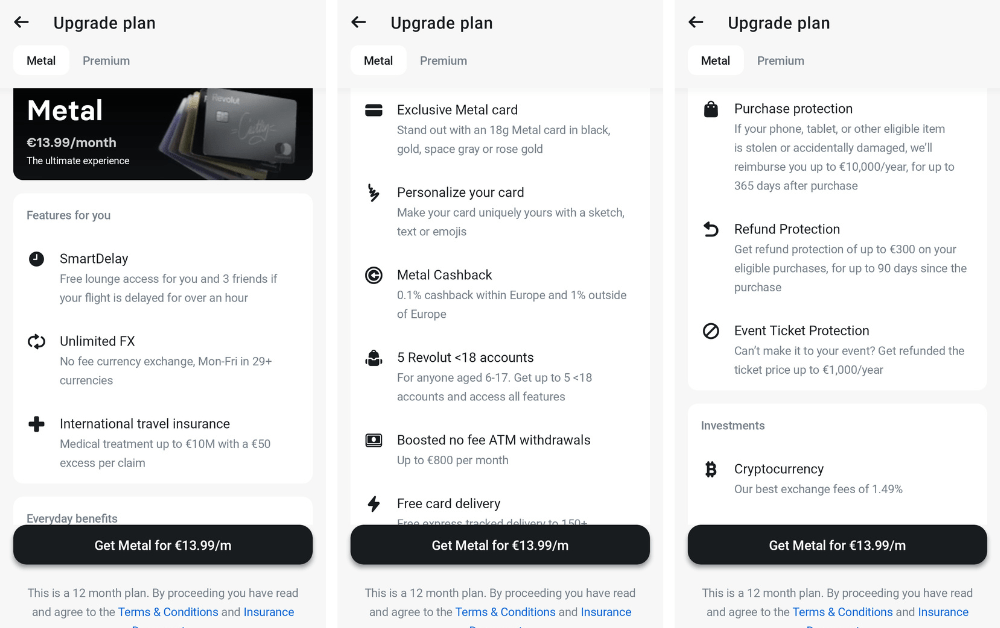

Revolut has four plans on offer. One of them free.

And if you simply want an everyday mobile payments app or digital wallet with no frills, the free account will do.

But if you want additional features like a better savings rate (in the UK), travel, medical, and phone insurance, open up to 5 kids accounts, get discounted international money transfers, and some other cool benefits, you’ll want to upgrade your account.

With Revolut, you can also start investing in stocks, crypto, and commodities from the get-go. Choose from 1,500+ global companies’ shares and more than 90 cryptocurrencies.

The app also offers cheap international money transfers, as well as cashback with your favorite retailers.

I could go on and on, but it’s best to check out their website directly for more info.

Starling (UK)

| Starling Pros | Starling Cons |

|---|---|

| No monthly fees | Low savings interest rate |

| No fees for spending in other countries | Low daily limit for ATM withdrawals (£300) |

| Euro account | |

| The first recycled plastic card in the UK | |

| Cash deposits in Post Offices | |

| Personal, business & joint accounts |

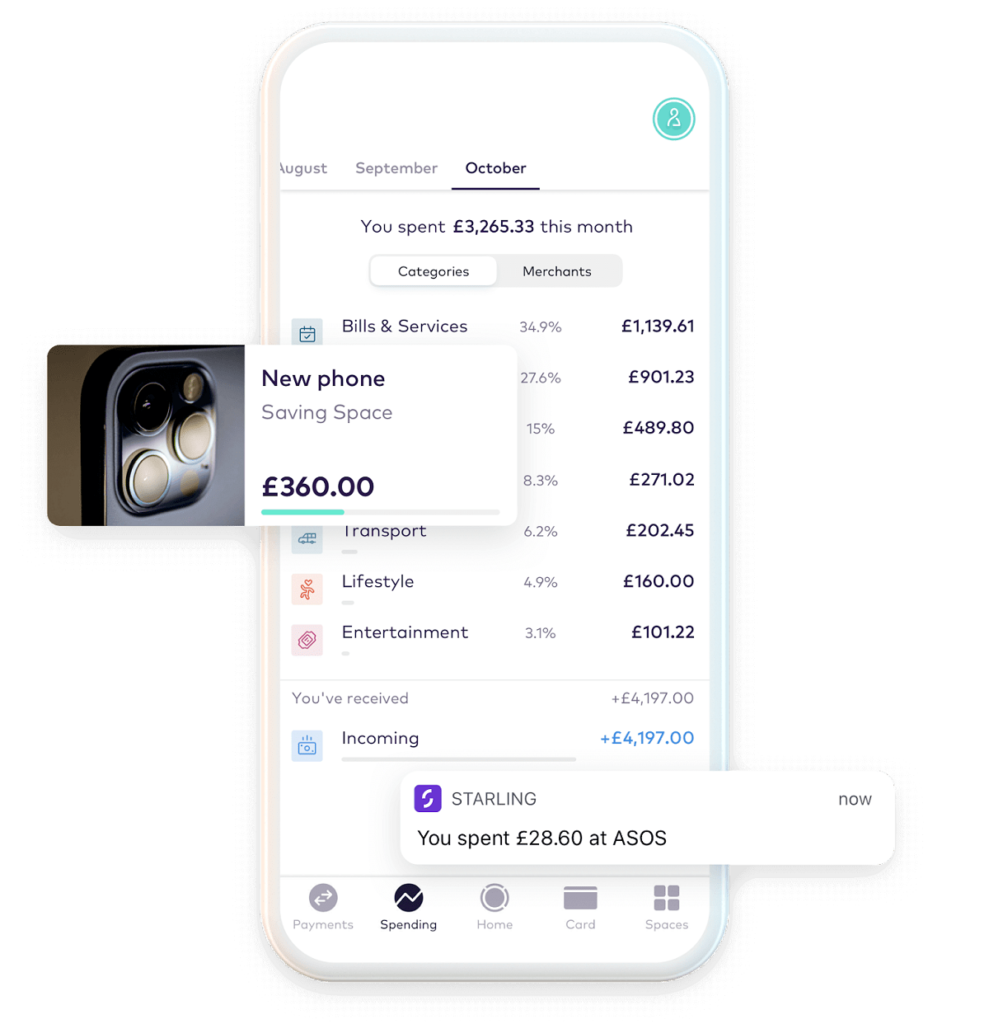

Starling is a leading challenger bank in the UK.

It didn’t venture into the EU yet and probably won’t. But if you live on the island, you’ll be more than satisfied with Starling.

You can get a free personal, joint, and Euro account. And if you have kids, there are two types of accounts – Starling Kite (for kids) and Teen account (for 16 and 17 year olds).

Starling is completely free and packed with features and benefits. Not to mention its marketplace, where you can find additional services such as insurance, mortgages, savings and investments, and more.

Opening a Starling account is very easy

I’ve said it before, and I’ll say it again, Starling is, hands down, the best bank in the UK for me.

Year after year, the bank has won an award for the best current account in the UK.

It makes money management easy with insights, budgeting, and analytics so you can see exactly where every penny is going.

I have nothing but words of praise for this challenger bank and would really like to see even more people around the UK using it. Starling Bank really is that great of an alternative to your high street bank and to Monese.

With their core banking services staying free, I can wholeheartedly recommend them.

Monzo (UK)

| Monzo Pros | Monzo Cons |

|---|---|

| Free accounts available | £15 per month |

| Worldwide travel insurance | |

| Interest on balance and regular Pots | |

| Fee-free withdrawals abroad | |

| 5 free cash deposits a month | |

| Phone insurance |

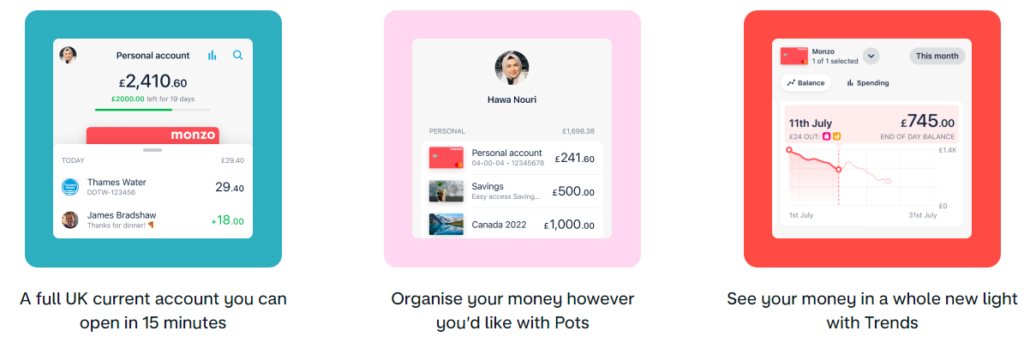

Monzo was founded as Mondo in 2015, and in 2017 it got its full banking license. The app is on track to surpass 6 million customers.

The mobile bank offers no monthly minimums, no account charges, all UK bank transfers for free, and no fees for UK ATM withdrawals.

Other benefits include standard options to freeze your card instantly if you lose it and no need to notify them that you’re about to travel abroad.

What I like most about Monzo is its high savings interest fees. They’re far higher than high-street banks and most digital banks.

There are three account types, one of them free. Just as is the case with Revolut, you can get away with the free account if you’re going to use it for money transfers, savings pots, and payments in-store and online.

If you want a unique holographic or stainless steel card, you’ll have to upgrade.

Paid accounts also have savings interest rates on your balance and regular pots.

Monzo Plus (£5/m) also has advanced roundups, a credit score tracker, fee-free ATM withdrawals abroad (up to £400/m), and one free cash deposit a month.

On top of that, Monzo Premium (£15/m) also has phone insurance, worldwide travel insurance, discounted airport lounge access, fee-free ATM withdrawals abroad (up to £600/m), and five free cash deposits a month.

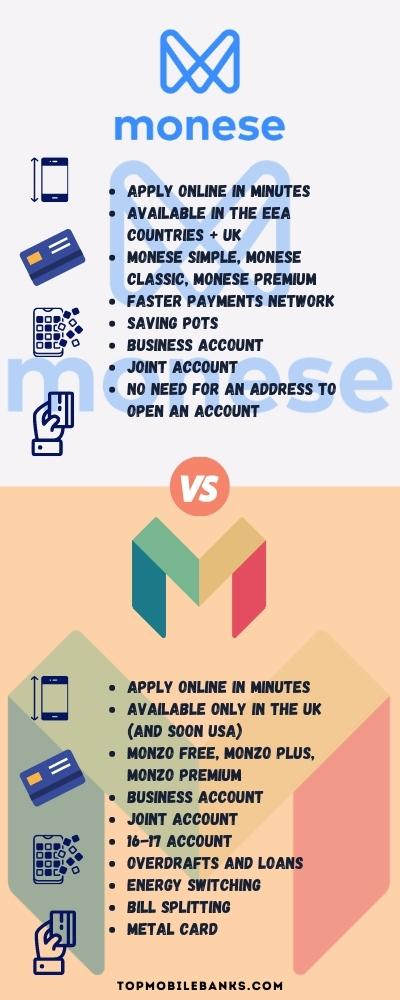

RELATED: Monese Vs. Monzo (What Is a Better Digital Account)

N26 (EU)

| N26 Pros | N26 Cons |

|---|---|

| Free accounts available | Can only hold one currency |

| Free payments worldwide | |

| Unlimited free ATM withdrawals worldwide | |

| Up to 10 sub-accounts | |

| Medical, trip, flight, mobility, and winter sports insurance | |

| Car rental and phone insurance | |

| Premium partner offers & unique experiences |

N26 is a German bank that was founded in 2013 by Valentin Stalf and Maximilian Tayenthal. The company has headquarters in Berlin but offers banking services across the Eurozone, the US, and Switzerland.

If you live in Europe and want a solid and reliable (digital) bank account, you should consider N26 Bank. Although it pulled out of the UK market, it is still going strong in Europe and is even expanding into other territories.

I love that there are almost no fees and its paid plans are an excellent choice for travellers.

The straightforward online application process makes N26 bank an attractively convenient option when compared with traditional banks. To open an account, customers must be over 18, have a smartphone to access their account, and have internet access.

EEA customers looking for a current account can choose between four monthly plans, the most basic of which is entirely free and offers free card payments in any currency.

The N26 ‘Smart’ plan will cost you €4.90 per month, offering the added benefits of free worldwide ATM withdrawals and exclusive partner offers. The ‘You’ plan is €9.90/m and has unlimited free ATM withdrawals worldwide, all kinds of insurance, and more.

The last option is N26 Metal – the flagship plan available for €16.90 per month, offering LoungeKey memberships, travel insurance, a dedicated priority hotline, an exclusive metal card, and more.

If you found this article useful, check more about digital banking written by our team: